Triple Whale serves as the ultimate data source empowering you to make informed decisions. Through seamless integrations with key platforms and specialized eCommerce AI, Triple Whale identifies essential data points tailored to your business needs, offering customization and personalization.

In their 2023 Industry Report, Triple Whale outlined the essential strategies to seize growth opportunities and achieve enduring long-term success.

Triple Whale prepared invaluable industry-specific actionable insights based on data from more than 4,500 stores. Let’s check it:

Sales Performance

Revenue

Established clothing brands maintain dominance with a 12.47% YoY growth, boasting the highest revenue per store at $8.54M. Changing demographics drive a 65.95% per-store revenue surge in the baby industry, correlating with increased U.S. birth rates. Food and beverage sees a 43.25% growth in per-store revenue, reflecting a shift to direct-to-consumer models and innovative marketing, exemplified by newcomers like Prime. Health and beauty thrive with a 37.63% growth, showcasing resilience through platforms like TikTok Shop during economic uncertainty.

New Customer Revenue

The Good: Every industry saw per-store revenue growth.

The baby industry led with an impressive +60.39% growth in new customer revenue, surpassing the +24.80% aggregate growth. Health and beauty followed at +44.32%, while food and beverage showed a solid +39.66% increase. These trends mirror total revenue increases, highlighting the significance of new customer acquisition for overall revenue growth. Clothing (+13.19%), sporting goods (+12.05%), and electronics (+12.09%) experienced the least growth in new customer revenue per store, aligning with overall revenue growth trends.

In 2024, companies will intensify efforts on new customer growth, focusing acquisition dollars on new customers and relying on lifecycle campaigns to drive LTV. Audience targeting and deliberate exclusions will be crucial to optimize spending on new customer acquisition for substantial revenue growth from non-ad-spend marketing within the existing customer base.

Orders

Some industries saw significant YoY growth, with the food and beverage sector leading with a remarkable +51.85% increase in orders per store. This surge indicates a strategic shift towards aggressive discounting, reflected in the -5.67% change in AOV, yet the tactic proved successful as growth nearly doubled the average. However, Electronics (+5.06%) and Sporting Goods (+6.71%) experienced minimal growth.

Looking ahead to 2024, the food and beverage industry is anticipated to surpass the baby and health and beauty sectors in order growth. The consumable nature of products in this sector, coupled with repeat purchase behavior and effective marketing, positions it for sustained success, especially if it continues to attract new customers with higher AOV products.

% New Customer Orders

The overall percentage of new customer orders remained relatively stable (+0.70%). Among the tracked industries, books experienced the highest increase in orders from new customers (+6.22%), reaching 62.20% by year-end. Conversely, food and beverage witnessed the most significant decrease in orders from new customers (-6.31%), attributed to the prevalence of subscription offerings in the industry.

Expecting continued reliance on new customers, reducing the initial average value (AV) could be an effective strategy to boost new customer growth. However, it is crucial to complement this approach with efforts to maximize customer lifetime value (LTV) through post-purchase engagement strategies such as personalized communications, loyalty programs and targeted marketing based on past purchase behavior.

Average Order Value (AOV)

The book industry saw a notable +8.51% increase in AOV, surpassing the modest -0.79% industry average. This surge is attributed to "BookTok," a TikTok community that influenced 50% of users in the US and Canada to read more. US annual book sales rose from 696 million in 2021 to 821 million in 2022, highlighting the impact of user-generated content (UGC). Retailers like Barnes & Noble capitalized on this trend, featuring BookTok recommendations on their website.

In the Baby vertical, there was a significant AOV increase of 16.6% YoY, surpassing the industry average. With the global baby products market estimated at $320.68 billion in 2023 and a projected 5.9% compound annual growth rate from 2024 to 2030, higher AOV growth is expected amid rising product costs due to inflation.

Looking to 2024, as companies focus on affordable options to attract new customers, AOVs may remain stable or decrease. A strategic emphasis on lifecycle marketing aims to convert first-time buyers into loyal customers, requiring brands to adapt pricing strategies for sustainable growth in a competitive digital marketplace.

Blended Advertising Performance

Key Takeaways

Advertising costs rise in competitive industries like health and beauty, pet supplies, and food and beverage, indicating increased investment in customer attention. Efficient advertising spending is seen in sectors like books toys and hobbies, with decreased CPCs and higher CTR signaling successful engagement strategies. Despite lower costs in some sectors, a decline in CTR suggests ongoing challenges in audience engagement. Changes in CPM indicate potential strategic shifts, with significant decreases in pet supplies and baby products and increases in toys and hobbies, reflecting industry dynamics. Return on ad spend (ROAS) varies widely, with sporting goods and clothing leading, while food and beverage and health and beauty require optimization.

Cost Per Click (CPC)

Despite a YoY increase in click-through rates (CTR), blended CPCs remain flat, emphasizing the need for brands to enhance creative strategies. Books show the most significant improvement in CPC YoY (-20.41%). Health & Beauty, Food & Beverage, and Pet Supplies have the highest CPCs ($0.87-$0.90). Only Baby, Electronics, and Health & Beauty saw CPC increases YoY. As impression costs rise, brands need innovative engagement strategies. In 2024, early trends indicate rising CPM, especially in an election year. Emphasizing engaging creatives is crucial.

Click-Through Rate (CTR)

Click-through rate (CTR) experienced a +9.6% YoY growth across all industries, with notable winners emerging. The introduction of Pmax and Advantage Plus campaigns optimized platforms for higher engagement, impacting overall CTR growth. This shift allows brands to focus on creative excellence, benefiting fashion brands significantly.

Clothing witnessed a substantial +38.14% YoY increase, attributed to the growth in product tagging and influencer content, especially on platforms like TikTok Shop. The ease of creating engaging video content with clear CTAs has led to success for many brands in the clothing industry.

Conversely, Baby (-10.49%), Electronics (-11.88%), and Health & Beauty (-11.33%) experienced CTR decreases, suggesting these industries may require more educational ads in the customer journey, as they are less prone to impulse purchases.

Looking ahead to 2024, with platforms emphasizing engagement campaigns and broader targeting, CTRs are expected to increase. Platform enhancements, including TikTok's focus on action-driven behavior and Google's Demand Gen, along with Facebook's Advantage Plus campaigns, will likely contribute to combat projected increases in CPMs.

Cost Per Thousand Impressions (CPM)

In 2023, every industry experienced a decrease in CPM, except Clothing, which saw a substantial +33.01% YoY increase, indicating a growing cost of advertising in this sector. Conversely, Books had the most significant negative YoY change at -17.30%, followed by Sporting Goods (-14.87%) and Art (-12.73%).

Looking ahead to 2024, the introduction of broad targeting options on social media platforms may help manage CPM, offering brands more reach and potentially reducing advertising costs. However, brands need to monitor the effectiveness of these campaigns as they could impact CTR. Additionally, an election year is likely to drive up CPMs, increasing competition in audience auctions. Brands should closely track CPM trends throughout 2024 to evaluate platform effectiveness across the funnel.

Cost Per Acquisition (CPA)

In 2023, Cost per Acquisition (CPA) had an 8.26% YoY change, indicating brands spent less to acquire customers. Pet Supplies had the highest CPA at $53.98, reflecting intense competition in a $143 billion US market. Baby supplies saw a +22.79% CPA increase, unlike other top industries (Pet Supplies and Clothing) that experienced drops in CPA. Toys & Hobbies led with the lowest CPA at $7.72, followed by Clothing at $15.82.

Despite increased costs for clothing brands, they improved efficiencies in CPA, possibly due to better creative conversion and accurate product descriptions.

Looking to 2024, if conversion rates improve, CPA may decrease further with better targeting and creative advertising. The decrease in CPA amid increased CPM underscores the importance of strategic media buying and prioritizing quality impressions. Brands should consider the entire customer journey for optimal acquisition value, focusing on post-click experience, customer service, and retention strategies. Purchase behavior is expected to shift towards Meta and TikTok Shop, impacting conversion rates, and segmenting performance between shops and sites will be key in 2024.

Return on Ad Spend (ROAS)

Return on Ad Spend (ROAS) increased for most industries in our data, showing promising overall growth. Clothing leads with a strong 5.45% in 2023, a slight increase from 2022 (+3.61%). 'Stay at home' or leisure industries, like reading, pets, and food/beverage, experienced significant ROAS growth, possibly stemming from pandemic-induced shifts in consumer behavior.

Looking to 2024, the apparel and home and garden sectors are expected to maintain their ROAS lead. The baby products sector may see growth by adopting strategies similar to the apparel industry, emphasizing accelerated returning customer cycles. Overall, ROAS figures across industries are likely to remain relatively flat as companies balance efficiency and growth. The emphasis on acquisition channels beyond paid advertising may lead to evaluating new customer ROAS or contribution margin numbers to optimize campaigns and channels.

5 Predictions for 2024

The holiday season is behind us, and Blue Monday has passed. It's now the fresh start of 2024, and as a brand owner or marketer, you're probably well-acquainted with the valuable lessons from 2023. Now, it's time to apply those lessons, aiming to make the next endeavor even more successful.

1. Facebook and Instagram will be more stable and profitable places to advertise than in years past

Facebook, with over three billion monthly active users, remains the world's most popular social media network. According to a 2022 poll, 96% of social media marketers consider Facebook advertising the most efficient compared to other platforms. It has historically delivered the best return on investment, crucial for marketing success on the platform.

While other networks compete for market share, Meta must ensure marketers remain confident in driving sales. Beyond potential ad ROI, Facebook and Instagram offer excellent opportunities for brand awareness without spending. With continually improving algorithms, reaching ideal customers is easier on Meta platforms.

In 2024, Meta has adjusted algorithms, incorporating more AI to personalize content on Facebook and Instagram based on user behavior. If you understand your target market, you can leverage this to your advantage. In 2023's BFCM, over 71% of ad spend for 11,000+ brands was on Meta, indicating it will likely remain a steady advertising platform in 2024.

2. Google will be a less lucrative place to advertise products than in 2022 and 2023

As Google shifts towards an AI-first model, adapting away from search, there may be growing pains. AI is now integrated into the ads interface, generating images and offering AI-powered insights. However, the learning curve is steep, potentially leading to lower return on ad spend (ROAS). While Google has been stable since 2021, Meta's Advantage+ campaigns are making it even more reliable, drawing ad dollars away from Google in 2024.

Another significant change for Google Ads in 2024 is the expected deprecation of third-party cookies by Q3. With fewer third-party cookies, advertisers must rely on first-party data for accurate targeting.

Google Ads are also becoming more expensive, with the average cost-per-click (CPC) across industries reaching $4.22 in 2023, compared to $2.32 in 2022. This rise, potentially influenced by inflation, raises questions about Google's value for advertisers.

3. TikTok will establish itself as a legit shopping platform

TikTok Shop's introduction poses a significant challenge to Meta, as TikTok aims to grow its US Shop to $17.5 billion in 2024. Designed for creators, TikTok thrives on businesses leveraging trends and viral moments for impactful brand exposure. With over 150 million monthly users in the USA, the platform offers a cost-effective opportunity to reach customers, despite an impending shift in take rates.

Triple Whale predicts creators tagging products and brands investing in TikTok Shop will reap benefits. TikTok Live Shopping Ads, facilitating live video discovery, present a substantial opportunity, influenced by the thriving livestream shopping culture in China. While not yet mainstream in the West, there's evident potential as trends often originate in the East.

4. Brands will struggle to sell products at full price any day of the year

For brands, customers anticipating sales represent an opportunity for proactive advertising. Ensuring profitable markups on goods during promotions is crucial. However, as TikTok evolves into a shopping-focused platform, there's a concern that user experience may suffer. Similar to Instagram's transformation, which prioritizes revenue for Meta, increased shopping functionalities could deter user growth and engagement in the long run.

5. 2024 will be the best year for eCommerce brands - and all businesses that sell online - since 2020

Remember 2020? eCommerce thrived due to the pandemic, hinting at accelerated adoption. However, 2021 didn't see a proportional rise as people still preferred physical stores. 2022 carried a post-pandemic hangover, and 2023 faced cautious spending amid economic challenges.

But 2024 marks a new beginning. Brands surviving 2021 can anticipate one of the best years since the pandemic. The blend of physical and digital channels, known as "phygital," is irreversible. Brands embracing this shift thrive, especially with options like buy online, and pick up in-store.

AI integration is expected to enhance eCommerce, from chatbots to content creation and marketing optimization. With improved tools and a slightly brighter economic outlook, Triple Whale looks forward to a promising 2024!

Leveraging 2023 Data to Drive Growth in 2024

Given our analysis of sales and advertising performance between 2022 and 2023, here’s what Triple Whale recommends for eCommerce brands planning for 2024 and beyond.

1. Invest in content marketing

In the competitive eCommerce landscape, a strong content strategy is crucial for seizing growth opportunities. Here are key strategies to consider:

Build an Internal Content Team: Create a team deeply familiar with your brand, products, and business goals to generate unique and authentic content, setting you apart from competitors.

Develop a Distinct Brand Voice: Craft a storytelling approach that resonates with your target audience, aligning it with industry trends and consumer behaviors to stand out in the Direct-to-Consumer (DTC) market.

Maximize Organic Social Media Impact: Focus on Instagram, TikTok, and YouTube to drive organic brand awareness and revenue growth. Invest in high-quality video content and collaborate with influencers for increased engagement.

Utilize Creative Cockpit for Paid Social Growth: Triple Whale’s Creative Cockpit offers detailed insights into advertising performance, helping you identify top-performing creatives for effective paid social expansion.

Leverage User-Generated Content (UGC): Encourage customers to create content featuring your products, building trust and community. Incentivize with exclusive discounts or rewards to boost social media UGC.

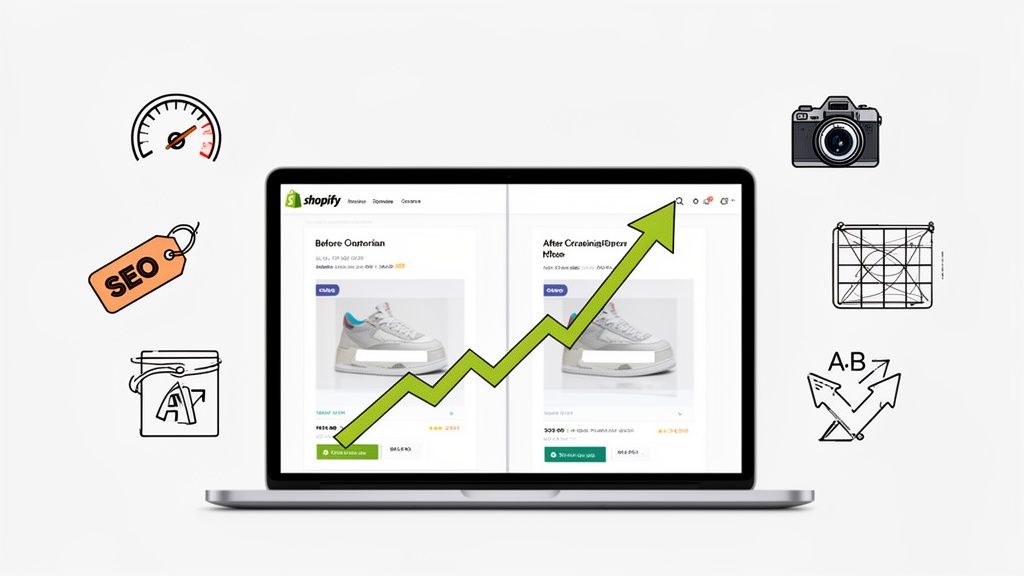

Implement an SEO-Driven Content Strategy: Conduct keyword research to optimize product descriptions and create blog content addressing customer pain points and interests, tailoring content to lifestyle and educational themes in relevant industries.

A robust content strategy enhances brand visibility, and engagement, and fosters a deeper connection with your audience, crucial for both immediate sales and long-term loyalty.

2. Develop An Outreach-based growth flywheel

Take control of your brand's growth with a focused growth flywheel. Here's how:

Collaborate with Mid-Sized Influencers: Partner with influencers aligned with your brand values, enhancing visibility and engagement, particularly effective in high ROAS industries like clothing and sporting goods.

Expand Distribution with Brick-and-Mortar Retailers: Reach out to small and medium-sized retailers for retail distribution, tapping into new customer segments and increasing brand visibility alongside your online presence.

Connect Through Event Marketing and Community Building: Engage with followers on social platforms, host events like pop-up booths or online webinars, and build a community to educate customers and strengthen loyalty.

Invest in Email Marketing: Develop personalized email campaigns for lead nurturing and maintaining direct communication with tailored content and offers, ensuring control over audience connection.

Implement Referral Programs: Create programs incentivizing current customers to bring in new ones, leveraging trust and loyalty to attract new shoppers.

These outreach-focused strategies not only boost sales but also cultivate a loyal customer base for sustainable growth in 2024.

3. Focus on profitability

Achieve quick profitability with these strategies:

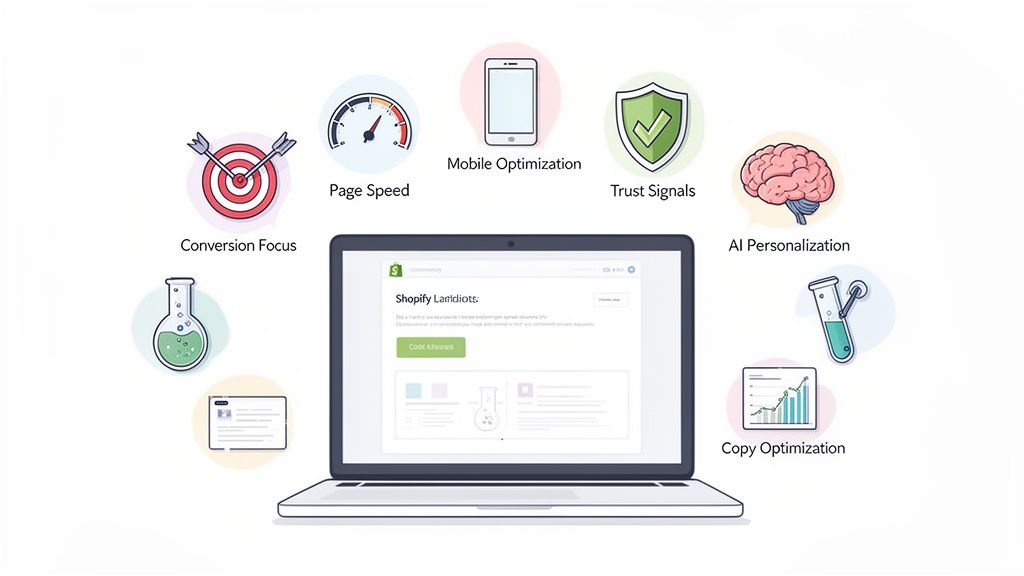

Prioritize Early Profitability: Optimize cost structures and pricing from the first purchase to establish a strong foundation for scaling. Utilize Triple Whale for real-time profit tracking and margin analysis.

Adopt a Data-Driven Pricing Strategy: Refine pricing using data analytics, considering customer behavior, market trends, and competitor pricing. This is crucial in industries with varying AOV like pet supplies or food and beverage.

Diversify Revenue Streams: Explore new products, subscription models, or complementary services to reduce reliance on a single market. This provides stability and opens avenues for growth, especially for expanding market reach.

Experiment with Product Bundling: Encourage larger purchases through product bundling or package deals, increasing perceived value and boosting AOV. Triple Whale’s Cart Analysis helps identify effective product bundles.

This data-driven, customer-centric approach ensures profitability and sets the stage for long-term, sustainable growth.

4. Improve your inventory management

Optimize inventory management with these strategies:

Leverage Scarcity Marketing: Create demand by releasing limited editions or small batches, fostering urgency and exclusivity. Prevent overstocking while keeping customer interest high.

Adopt a Lean Approach: Maintain minimal stock to meet demand, improving cash flow and reducing storage costs. This strategy prevents excess inventory, leaving some demand unmet.

Use Demand Forecasting: Analyze sales data and market trends for accurate inventory predictions. Effective forecasting prevents overstocking, ensuring you meet customer demand without excess risk.

Implementing these inventory management strategies will lead to a more profitable and sustainable business model.

Methodology

Triple Whale analyzed data from 4,500+ Shopify brands, each with a GMV exceeding $1 million in 2023. The focus was on top-performing industry verticals, and stores meeting specific criteria were included.

Selected Industry Verticals:

- Ara

- Baby Products

- Books

- Clothing

- Electronics

- Fashion Accessories

- Food and Beverage

- Health and Beauty

- Home and Garden

- Other

- Pet Supplies

- Sporting Goods

- Toys and Hobbies

Stores were included if they met the criteria:

- Valid currency conversion to USD

- AOV between $1 and $1,000

- Complete 2022 and 2023 data

- $1M+ in GMV in 2023

To address potential selection bias, closed stores or those with GMV below $1 million in 2023 were excluded.

Ad channels were included if they met the criteria:

- Valid currency conversion to USD

- Daily spend exceeding $100

- Daily reported revenue exceeding $100

- ROAS less than 50

Blended ad metrics covered Meta, Google, TikTok, Bing, Pinterest, Amazon, Snapchat, and Twitter, with a focus on Meta, Google, and TikTok.

Metrics Definitions:

- Average Order Value (AOV): Conversion Value / Purchases

- Cost per Click (CPC): Spend / Clicks

- Click-Through Rate (CTR): Clicks / Impressions

- Cost per Thousand Impressions (CPM): Spend / Impressions

- Cost per Acquisition (CPA): Spend / Purchases

- Return on Ad Spend (ROAS): Conversion Value / Spend

Explosive growth was observed in some verticals, while others, like Electronics (+5.06%) and Sporting Goods (+57.41%), saw more modest increases.

If you want to dive deeper into last year retrospective and review, check our post with 2023 year review