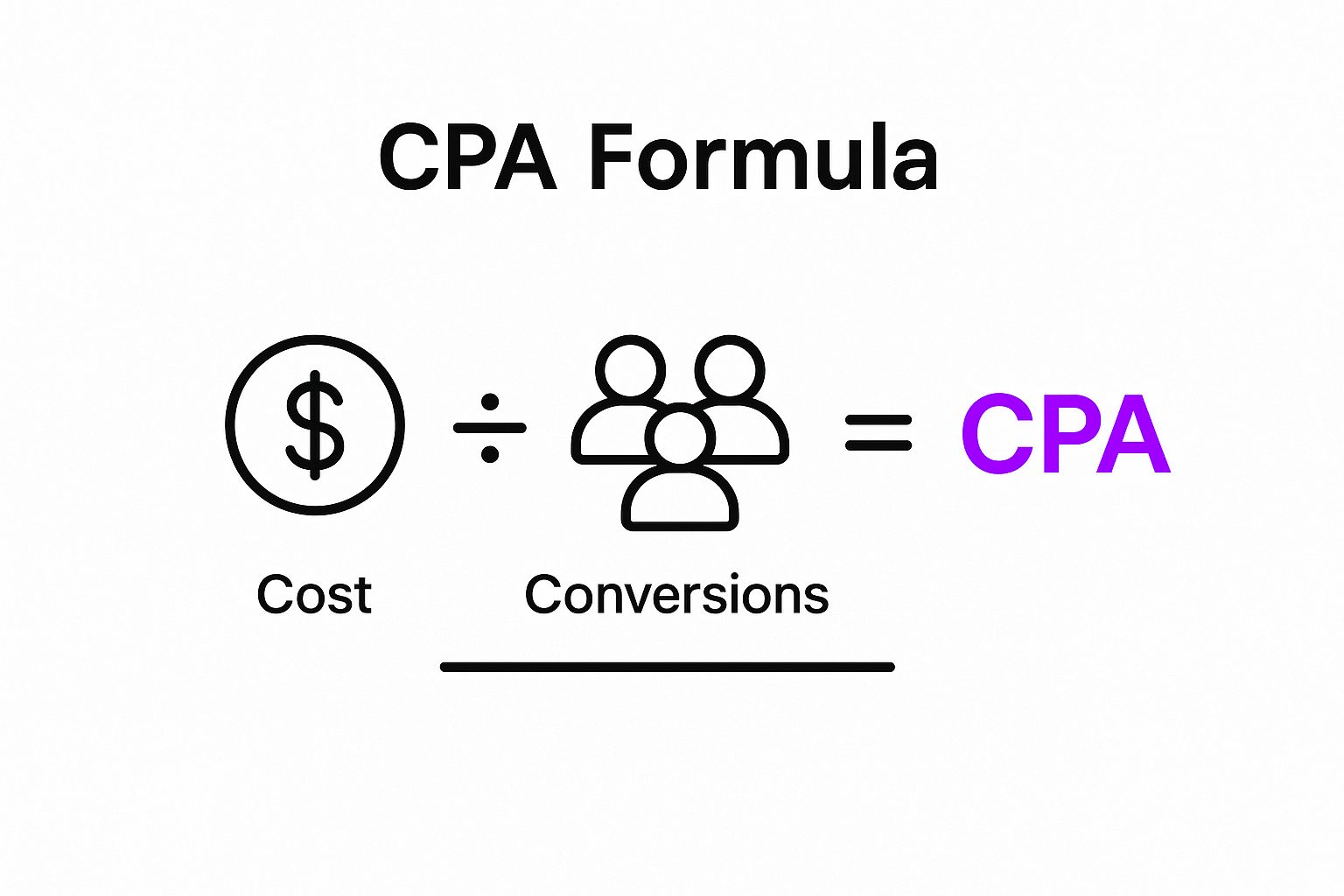

Calculating your Cost Per Acquisition, or CPA, is actually pretty simple on the surface. You just divide the total cost of any given marketing campaign by the number of new customers you got from it.

That simple formula is the quickest way to answer the all-important question: how much are you really spending to get each new customer? For any Shopify store owner, that's a number you've got to know.

Your Quick Guide to Calculating CPA

Before you get lost in a sea of spreadsheets and analytics dashboards, it’s crucial to get a solid grip on the basics of the CPA formula. Getting this metric right is the first real step toward making smarter calls with your marketing budget and ensuring your ad spend is actually fueling profitable growth.

Honestly, think of it as the foundational language of performance marketing.

The Essential CPA Formula

At its heart, the formula for Cost Per Acquisition is just your total marketing cost divided by the number of new customers that campaign brought in.

Let’s say your Shopify store dropped $10,000 on a new marketing campaign, and it brought you 1,000 brand-new customers. Your CPA would be a clean $10. This little bit of math gives you a clear, immediate benchmark for how efficient that campaign was. If you want to dig a bit deeper into the basics, some leading industry blogs offer great primers.

Key Takeaway: When you strip it all down, CPA is about one thing: connecting what you spend directly to what you get. It cuts through the noise and tells you exactly what it costs to win over a new paying customer.

This single number helps you answer the most critical question in eCommerce advertising: "Is this campaign actually worth the money?" If your average customer spends $50 and your CPA is only $10, you’re in a fantastic spot.

Breaking Down the Components

To really nail your CPA calculation, you need to be crystal clear about the two main variables in the equation. Let's look at what each part really means for a Shopify store.

Here’s a quick breakdown to keep on hand.

CPA Calculation at a Glance

Initially, you might just count your ad spend (the cash you hand over to Meta or Google) as the "Total Marketing Cost." And for "New Customers Acquired," you're looking for the count of first-time buyers who came from that specific campaign.

Mastering this basic version sets you up perfectly for a more advanced, and more accurate, analysis—which we’ll jump into next.

What Actually Goes Into Your CPA Calculation

The basic CPA formula is a solid start, but if you're only looking at ad spend, you're getting a dangerously incomplete picture of your marketing performance. To really nail down how to calculate cost per acquisition, you have to pull back the curtain and account for all the other costs that fuel your campaigns.

Ignoring them is like trying to calculate the cost of a cake by only counting the flour. Think beyond that single number in your Google Ads dashboard. Your real campaign costs include every single dollar spent to make that acquisition happen. A flimsy calculation leads to flawed decisions—you might think a campaign is profitable when it's actually leaking money.

Uncovering Your True Campaign Costs

So, what else should you be tracking? The goal is to get a complete list of every expense tied directly to a specific campaign. This means digging into the costs that often get overlooked in a quick-and-dirty analysis.

To get an accurate CPA, you have to include:

- Creative Production: Did you hire a photographer for new product shots? A videographer for that slick new ad? A graphic designer for a set of banners? All those invoices are part of the campaign's cost.

- Agency or Freelancer Fees: If you're paying an agency a monthly retainer or a freelancer for their expertise, a portion of that fee needs to be allocated to the campaign.

- Software and Tools: Don't forget the subscription fees for your design software (like Canva or Adobe Creative Suite), analytics tools, or landing page builders. These are the tools that make the work possible.

- Team Salaries: This one can be tricky, but it's crucial. If someone on your team spends 25% of their time managing a campaign, then 25% of their salary for that period is a campaign cost.

By rolling all these expenses into your calculation, you transform CPA from a simple vanity metric into a real, actionable business metric that reflects your true acquisition expenses.

A common mistake is stopping at ad spend. True CPA calculation requires a comprehensive audit of all related costs, from creative development to the tools and people that make the campaign run.

A Shopify Store CPA Example in Action

Let's walk through a real-world scenario. Imagine a Shopify store selling custom pet portraits runs a month-long campaign on Facebook and Instagram.

At first glance, they just look at their ad platform metrics:

- Total Ad Spend: $10,000

- New Customers Acquired: 125

- Initial CPA: $10,000 / 125 = $80

Not too bad, right? But that's not the whole story. Let's layer in the other costs.

- Freelance Designer (for ad creative): $1,000

- Marketing Manager's Salary (allocated at 20% of their time): $1,200

- Design Software Subscription (for the month): $50

Now, the Total Campaign Cost is actually $10,000 + $1,000 + $1,200 + $50 = $12,250.

Let's recalculate with the real numbers: $12,250 / 125 = $98. That's a 22.5% increase from the first, simplistic calculation! This more honest number gives a much clearer view of whether the campaign is actually profitable.

In real-world scenarios, consolidating all expenditures is key. One company's digital campaign cost totaled $18,000 after including production and staff, resulting in a true CPA of $120 for 150 acquisitions. You can learn more about these detailed calculations in this insightful post from Salesforce. This detailed approach is the only way to get a true picture of profitability.

Calculating CPA for Different Marketing Channels

An overall, blended CPA is a decent starting point—it's like a quick health check for your marketing efforts. But the real magic happens when you zoom in. To truly get the most out of every dollar, you need to calculate CPA for each specific marketing channel you're running.

This is where you find out which platforms are your all-stars and which ones are just draining your budget with little to show for it.

The core formula doesn't change: it's always your total cost divided by new customers. The trick is to be meticulous about isolating the costs and the resulting acquisitions for only that specific channel. You're no longer looking at your total marketing spend; you're looking at what you spent on Google Ads, that Instagram campaign, or your latest influencer collaboration.

This breakdown shows the simple, universal logic at the heart of every CPA calculation you'll run.

Whether you're looking at a single ad or an entire channel's performance, Cost ÷ Conversions = CPA is your north star.

Isolating Google Ads CPA

For a platform like Google Ads, this is pretty straightforward. The platform’s built-in conversion tracking is solid, making it easy to see exactly how many new customers came directly from your search or shopping campaigns.

Your math is simple:

- Total Google Ads Spend: The amount you paid for clicks over a set period.

- Total Conversions from Google Ads: The number of new customers attributed to those ads.

So, if you spent $3,000 on Google Ads in a month and brought in 60 new customers, your Google Ads CPA is a clean $50.

Figuring Out Influencer Marketing CPA

Influencer marketing can be a bit more nebulous, but you can definitely pin down the CPA. Your "Total Cost" here needs to be more comprehensive than just the influencer's fee. Don't forget to add in the cost of goods for any free products you sent and any agency fees if you used one to manage the partnership.

Attribution is key. The best way I've found to track sales from an influencer is to:

- Give each influencer a unique discount code (e.g., "HANNAH15").

- Then, just track how many times that specific code is used at checkout.

Let's say you paid an influencer $1,000 and sent them $200 worth of product. If their code was used by 48 brand-new customers, your CPA for that collaboration is a very respectable $25. (That's $1,200 / 48).

By focusing on specific channels, CPA differs from broader metrics like Customer Acquisition Cost (CAC), which looks at all acquisition spending. For example, a $5,000 social media campaign that yields 250 new customers results in a channel-specific CPA of $20. This distinction is vital for accurate campaign analysis. You can discover more insights about comparing CPA and CAC on Geckoboard.com.

Breaking Down Instagram Ads CPA

Calculating the CPA for an Instagram campaign works much like it does for Google Ads, but with its own set of costs to consider. Your total spend includes the ad budget you see in Meta Ads Manager, but you should also factor in any costs for creating the video or image assets you used in the ads.

For instance, maybe you spent $2,500 on Instagram ad placements and also paid a creator $500 for the ad creative. Your total cost is $3,000. If your Meta Pixel attributed 75 purchases to this campaign, your Instagram CPA lands at $40.

Getting this kind of channel-specific clarity is what empowers you to shift your budget toward the platforms that are actually delivering profitable growth.

Channel-Specific CPA Comparison

Let's put this into practice with a quick comparison. Imagine you run a Shopify store and spent money across three different channels last month. Looking at them side-by-side makes it crystal clear where your money is working hardest.

Based on this data, the influencer collaboration delivered the most efficient acquisitions, with Instagram Ads coming in second. While Google Ads had the highest CPA, it might be driving higher-value customers, which is why you can't look at just one metric in a vacuum! Still, this gives you a powerful starting point for budget allocation.

Defining a Good CPA for Your Shopify Store

Alright, so you've tracked your costs and nailed down how to calculate CPA for each of your channels. Now for the million-dollar question: is your CPA number any good?

A $50 CPA could be a total disaster for one store but an absolute home run for another. This is one of those times where the answer is frustratingly, "it depends."

The truth is, a "good" CPA is completely relative. It’s not about chasing some universal magic number. It’s all about what that acquisition cost actually means for your business, your margins, and your growth plan. Context is everything.

The Critical Link Between CPA and CLV

The single most important metric to pair with your CPA is Customer Lifetime Value (CLV). This is the total revenue you can realistically expect from a single customer over their entire relationship with your brand.

When you look at CPA through the lens of CLV, the picture gets a whole lot clearer.

Think of it this way:

- CPA is the cash you spend upfront to get a customer through the door.

- CLV is the total value that customer brings you over the long haul.

A CPA that seems high on the surface can be perfectly fine—even fantastic—if your CLV is significantly higher. For example, spending $100 to acquire a customer who makes a single $120 purchase (with a $40 profit margin) isn't a winning strategy. You're losing money.

But spending that same $100 on a customer who comes back three more times, generating a total CLV of $500? That’s a massive win you should be trying to replicate all day long.

Your goal isn't just to acquire customers cheaply; it's to acquire profitable customers. A healthy business model ensures your CLV is substantially higher than your CPA, typically by a ratio of 3:1 or more.

Using Industry Benchmarks as a Guide, Not a Rule

It’s tempting to Google "average CPA for eCommerce" and see how you stack up. While industry benchmarks can give you a general sense of direction, treating them as gospel is a huge mistake.

Those averages lump together wildly different businesses. A store selling $20 t-shirts is playing a completely different game than a store selling $2,000 custom furniture. Their CPA targets will, and should, be worlds apart. Your product's price, your margins, and how often customers re-order are what truly define an acceptable CPA for you.

How to Define Your Own Target CPA

To set a target that actually means something, you have to work backward from your own numbers. The best place to start is with your Average Order Value (AOV) and your gross profit margin.

Let's walk through an example. Say your AOV is $150 and your gross margin is 60%. This means you make $90 in gross profit from the average first-time purchase.

From that $90, you still need to subtract all your other operational costs—think shipping, fulfillment, software subscriptions, etc. After all that, maybe you're left with $50 in net profit before you've spent anything on marketing.

In this scenario, any CPA below $50 means you're profitable on the very first sale. That gives you a clear, data-driven ceiling for what you can afford to spend, creating a solid foundation for scaling your marketing without burning cash. This simple calculation takes you from just knowing how to calculate CPA to strategically applying it to grow your business.

Proven Strategies to Lower Your CPA

Okay, so you know how to calculate your CPA and you’ve figured out a good target for your store. Now the real work begins.

The whole point isn’t just to track this metric—it’s to actively drive it down. Lowering your Cost Per Acquisition means every single marketing dollar you spend works harder. This directly boosts your profitability without you having to hit the brakes on growth.

The good news? You don’t need to completely overhaul your budget to see a difference. Often, it’s a few strategic tweaks that lead to the biggest improvements. Small, consistent optimizations are what separate the stores that scale efficiently from the ones that are always struggling.

Refine Your Ad Targeting

Want to burn through your ad budget at record speed? Show your ads to the wrong people.

Seriously, a lower CPA almost always starts with tightening up your audience definitions. Stop using broad targeting and get laser-focused.

Think way beyond basic demographics. Dig into your customer data and build detailed lookalike audiences based on your best customers, not just all of them. If you’re selling high-end running shoes, your ideal audience isn’t just “people interested in running.” It's people who have bought premium athletic gear before, follow specific running influencers on Instagram, and live in areas with active running communities.

Imagine a Shopify store selling sustainable baby clothes. They could target users who follow eco-conscious parenting blogs and have shown interest in organic cotton products. This level of specificity ensures your ad spend is concentrated on shoppers who are actually likely to convert, which immediately starts pushing your acquisition costs down. For a deeper dive, check out our guide on how to reduce customer acquisition cost with more advanced strategies.

Optimize Your Shopify Product Pages

Your ad is just the first handshake. If a user clicks through to a confusing, slow, or unconvincing product page, you’ve just wasted that ad spend. A high-converting product page is one of your most powerful weapons for lowering CPA.

Start with the essentials:

- High-Quality Visuals: Use crystal-clear product photos from every angle. Better yet, add a short video showing the product in action.

- Compelling Copy: Your description needs to solve a problem and scream benefits, not just list features. Anticipate common questions and answer them right there in the copy.

- Social Proof: Make your customer reviews, star ratings, and user-generated content impossible to miss. Shoppers trust other shoppers more than they'll ever trust you.

A classic mistake is pouring 100% of your optimization energy into the ad creative. Remember, the ad's only job is to get the click. It’s your landing page’s job to get the sale. A tiny 1% increase in your conversion rate can have a massive impact on your CPA.

Enhance Your Ad Creative

In a social feed that’s more crowded than ever, generic ads are completely invisible. Your creative has to be a scroll-stopper that immediately communicates value.

You need to be constantly testing different formats to see what clicks with your audience.

This could mean trying out:

- Video Testimonials: Get a real customer on camera sharing their authentic experience.

- Problem-Solution Ads: Show a common pain point and how your product is the perfect solution.

- User-Generated Content (UGC): Repurpose authentic photos or videos from your customers (with permission, of course!).

For example, a skincare brand could run a test comparing a polished, studio-shot ad against a raw, selfie-style video from a happy customer. More often than not, the authentic UGC-style ad will outperform the slick one because it feels more trustworthy. This leads to a higher click-through rate and, you guessed it, a lower CPA.

Always be testing. What worked wonders last month might be totally ignored today.

Answering Your Top CPA Questions

Once you start digging into CPA for your Shopify store, a few questions always seem to surface. Getting these sorted out is the key to actually using this metric with confidence and making smarter calls with your marketing budget.

Let's break down the common sticking points we hear from store owners all the time.

CPA vs. CAC: What's the Real Difference?

So many people use CPA (Cost Per Acquisition) and CAC (Customer Acquisition Cost) interchangeably, but there's a small yet crucial difference. It all comes down to what specific action you're actually paying for.

CPA is the broader term. It can measure the cost to get something other than a paying customer—think an email signup, someone starting a free trial, or just a lead filling out a form. For instance, if you drop $500 on a campaign to grow your newsletter list and you get 100 new subscribers, your CPA for a subscriber is $5.

CAC, on the other hand, is laser-focused. It only measures the cost to acquire a new, paying customer.

For most eCommerce stores running ads to drive sales, your CPA and CAC will often be the exact same number. But if you have a more complex funnel with multiple steps, knowing the distinction is super important.

While they're related, CPA measures the cost of a specific action (like a lead or signup), while CAC measures the cost to gain a paying customer. For most direct-to-consumer sales campaigns, these metrics often end up being the same.

How Often Should I Calculate My CPA?

The right answer here really depends on the marketing channels you're using. There's no one-size-fits-all rule, but here's a good guideline to follow: match your calculation cadence to your optimization cadence.

- Weekly for Paid Ads: When you're dealing with fast-moving channels like Google Ads or Meta campaigns, you need to be checking your CPA at least once a week. This lets you spot trends, kill ads that are bleeding money, and shift your budget before you waste too much on what isn't working.

- Monthly or Quarterly for Organic Channels: For the slow-burn strategies like SEO or content marketing, checking in weekly is pretty pointless. For these, a monthly or even quarterly calculation gives you a much more realistic and practical view of how things are performing.

Can You Calculate CPA for Organic Channels Like SEO?

Absolutely, and you definitely should. It’s a bit trickier than with paid ads, but figuring out your SEO CPA is the only way to truly compare its long-term value against your paid campaigns.

To pull it off, you need to add up all your SEO-related costs over a set period, like a quarter or a year. This isn't just one number; it's a sum of a few things:

- Salaries for your in-house SEO team or agency retainers.

- Costs for content creation, whether that's freelance writers or your own team's time.

- Any expenses for link-building services or outreach.

- Subscriptions for your SEO tools, like Ahrefs or Semrush.

Once you've got that total cost, you just divide it by the number of new customers attributed to organic search during that same period. You can find this data in Google Analytics. Attribution is never perfect, but this gives you a powerful metric for a channel that, more often than not, delivers the best long-term ROI.

Ready to stop guessing and start growing? The team of Shopify specialists at ECORN can help you optimize your marketing channels, lower your CPA, and build a more profitable eCommerce business. Discover our flexible solutions today.